Table of Contents

Poupe Vongkhamchanh Mortgage Broker

1194 Jefferson Ave, Winnipeg, MB R2P 0C7(204) 960-0874

Click For Details

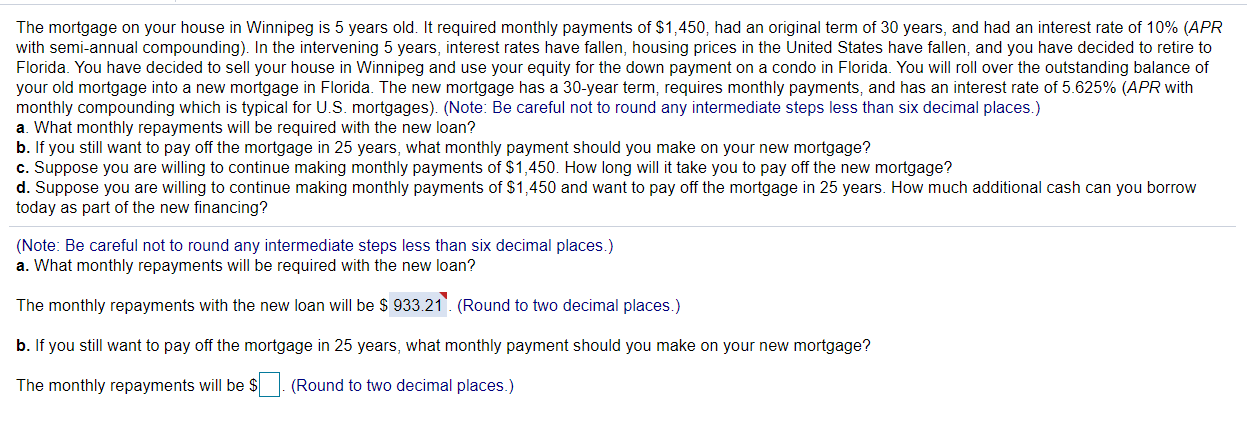

The home mortgage professionals at the Winnipeg Cops Cooperative credit union can deal with you to identify the optimum acquisition cost and the dimension of mortgage that you can afford, examine the mortgage options and settlement terms that will certainly work best for you, and additionally offer you an idea of the potential expenses entailed in acquiring your home.

60Monthly repayment $763 - construction loans. 21 Increased bi-weekly settlement choices are computed by taking your normal month-to-month settlement and splitting it by two and making the resulting repayment quantity every two weeks. Since you would be making 26 bi-weekly payments, by the end of a year you will have made the equivalent of one added month-to-month repayment

There are also some tax credit ratings newbie purchasers can utilize. There's the home purchasers' quantity, which is formerly understood as the First-Time Home Buyers' Tax Debt. This $5,000 non-refundable tax debt can be used by first-time purchasers as well as persons with impairments when they purchase a brand-new home.

Tax obligation is consisted of in the acquisition price of brand-new homes and this credit history enables you to recuperate the GST. The refund can be utilized on either a home that's acquired from a home builder along with a home you construct on your own.

Indicators on Mortgage Broker Winnipeg - Portage La Prairie - Brandon ... You Need To Know

Poupe Vongkhamchanh Mortgage Broker

1194 Jefferson Ave, Winnipeg, MB R2P 0C7(204) 960-0874

Click For Details

The number of years it will certainly take to repay a home loan in complete. A home loan might have a five-year term and a 25-year amortization period.

Something of value that you own. A home mortgage that combines the amount the customer owes under a current mortgage with added home loan money needed by the consumer. construction loans. The rates of interest for the new quantity borrowed is a "blend" (or mix) of the rate of interest of the "old home loan" and the rate of interest for the extra quantity to be borrowed

Navigation

Latest Posts

Untitled

Local Seo Case Study: £13m In Revenue In 2 Years - Questions

The Buzz on Vape Shop & Online Vape Shop - About Vape360